NLRB Says Your Severance Agreements May Violate Federal Law

The National Labor Relations Board Says Your Severance Agreements May Violate Federal Law

The swinging pendulum at the National Labor Relations Board (NLRB or the Board) continues, with the current Board overruling cases that were decided during the Trump administration (some of which overruled precedent from the Obama administration). In the recently decided case McLaren Macomb (372 NLRB No. 58), the NLRB set its sights on confidentiality and non-disparagement provisions in severance agreements. All employers – including those without unions – should take note of and are affected by this latest decision.

In McLaren, the NLRB found that the employer violated the National Labor Relations Act (NLRA or the Act) by presenting employees with a severance agreement containing confidentiality and non-disparagement provisions that, according to the Board, restricted employee rights under the Act. Importantly, the Board’s decision in McLaren Macomb applies only to severance agreements presented to nonmanagerial employees. The NLRA defines a “supervisor” (i.e., a manager) by considering factors that include, but are not limited to: whether the employee has authority to hire, fire, discipline, or responsibly direct the work of other employees.

The Board found the non-disparagement provision at issue violated employees’ NLRA Section 7 rights because “[p]ublic statements by employees about the workplace are central to the exercise of employee rights under the Act.” Similarly, the Board found that the confidentiality provision at issue violated employees’ Section 7 rights because it precluded employees from “disclosing even the existence of an unlawful provision contained in the agreement,” which, the Board argued, could persuade employees from filing unfair labor practice charges or assisting the NLRB in an investigation. The Board also determined the confidentiality provision to be unlawful because it prohibited employees from discussing the severance agreement with current or former coworkers, including those who may receive similar agreements, union representatives or other employees seeking to form a union.

WHAT SHOULD EMPLOYERS DO IN THE WAKE OF THE MCLAREN DECISION?

The McLaren decision makes clear that the Board will closely scrutinize whether the language of severance agreements restricts employees’ NLRA rights. Given this decision, employers should consider taking one or more of the following actions to minimize risk when offering severance agreements with confidentiality and non-disparagement provisions to non-supervisory employees:

- Assess the value of including confidentiality and non-disparagement clauses in the agreement at all and consider whether such clauses can be narrowly tailored so as not to violate employee rights under the NLRA.

- If a severance agreement contains confidentiality and non-disparagement clauses that might be interpreted as restricting employee rights, those restrictions should be as narrow as possible and make explicit that the agreement is not intended to preclude employees from asserting their rights under the NLRA.

- If including confidentiality and non-disparagement provisions, be sure to include “severability” language so that, even if a court or the Board ultimately finds these clause to be unlawful, the remainder of agreement will be enforceable.

Employers should consult with experienced human resources professionals and/or labor and employment counsel with any questions regarding the use of severance agreements with departing employees. For all MEA members, the Hotline is available to provide this assistance. For MEA Essential and Premier members, a Member Legal Services attorney is available for additional consultation.

Amy G. McAndrew, Esquire

Director of Legal and Compliance Services

MidAtlantic Employers' Association

800-662-6238

Update Your Employee Handbook

‘Tis the season—to update your company's employee handbook

An outdated handbook can be a liability, particularly for multistate employers with a widely-dispersed work force.

With 2023 around the corner, now is the time for employers to consider updating their employee handbooks. Handbooks, handed out at orientation and often thereafter ignored, are an important compliance tool for employers addressing all manner of employment issues. And handbook policies can be a helpful tool when defending a variety of employment claims, such as wage and hour violations, harassment and discrimination lawsuits, and leave disputes.

An outdated handbook however, can be a liability, particularly for multistate employers with a widely-dispersed work force. These employers in particular must be attuned to the myriad of different employment laws and must be aware of new developments in any states where any employee is located. These complicated compliance requirements may seem tedious or burdensome, especially in an environment where employers are already struggling with recruiting and hiring, but failure to do so can be costly.

Below, we highlight a few particularly key and nuanced issues to assess when deciding whether to update some of the most-referenced sections in any handbook - the paid leave policy, the expense reimbursement policy, and the anti-harassment and discrimination policies.

Paid Leave

The past year saw increasing calls for paid leave laws to be enacted at both the state and local level. And new paid leave laws have come into effect in several states in 2022, like New Mexico's Healthy Workplaces Act. Indeed, at least 11 states and municipalities have enacted paid leave laws and others are likely to follow. Consider these factors when assessing whether your leave paid policies may be in need of an update:

| 1. |

Pay attention to where employees are located and headcount. Depending on the laws in those jurisdictions, consider a state or local supplement to the main handbook to account for the nuances under greatly differing paid leave laws, which may apply depending on how many employees you have in a particular state.

|

| 2. |

Clearly explain employee eligibility. Federal law requires employers provide FMLA leave after one year on the job and 1250 hours worked and state and local requirements may require leave after less time on the job (e.g., Wisconsin's unpaid FMLA law only requires 1000 hours in the preceding 52 weeks). However, employers can also offer leave at any point before those requirements kick in. Ensure that your policy clearly explains when an employee may be eligible for various paid leaves and ensure that if such leave is protected by law, the policy is compliant.

|

| 3. |

Make sure your leave policies are not inadvertently discriminatory. For example, parental leave policies should apply equally to all types of new parents, although there is an important distinction to be made between paid leave for recovering from childbirth and paid leave for bonding or other non-medical reasons.

|

Expense Reimbursement

While federal law only requires that employers reimburse employees for expenses that bring an employee's earnings below the federal minimum wage, state and local laws vary greatly in the treatment of worker expenses and reimbursement. California, Illinois, Iowa, Massachusetts, Montana, New York and the District of Columbia require that employers reimburse employees for various work-related expenses. And further, several of those states consider expense reimbursement wages subject to the same timing requirements as regular payroll.

Lawsuits for failure to properly reimburse employees for expenses are rapidly increasing in these states and for all manner of expenses ranging from typicalwork-related expenses such as telephone and internet fees and the cost of office supplies, to the extra cost of energy to heat or cool a house. Expense reimbursement also raises questions regarding the ultimate ownership of devices and equipment, especially when employment ends. To address these issues, a good expense reimbursement policy clearly provides:

| 1. |

what expenses are reimbursable and by when the employer will reimburse the employee (applicable state law will govern these and set floors for reimbursement);

|

| 2. |

who owns the devices or equipment; and

|

| 3. |

how the equipment is handled when the employment relationship terminates (will they be wiped of company information and the employee can keep them, must they be returned, etc.?).

|

Protected Characteristics

Over the last several years, state and local authorities have expanded definitions of protected characteristics. At least 18 states and many municipalities have added protections for natural and protective hair styles, for example. Moreover, medical or recreational use of marijuana is now legal in 26 states. Several of those states such as Connecticut, Montana, Nevada, New Jersey, New York, and Rhode Island provide protections for employees that participate in off-duty recreational use of cannabis products and therefore limit an employer's ability to refuse to hire or take adverse action against those workers.

While catch-all language to include additional protected characteristics, such as "and any other characteristic protected by federal, state, or local law," is a common solution, adding the particular protected characteristic to the policy - and better still to harassment and discrimination training - can serve as a defense against liability.

At a minimum, every handbook should contain an Anti-harassment and Ani-Discrimination Policy that:

| 1. |

provides the state and local-specific characteristics that are protected from unlawful harassment and discrimination;

|

| 2. |

has a reporting procedure providing multiple reporting avenues for individuals to make complaints about harassment; and

|

| 3. |

emphasizes the employers commitment to maintaining a workplace free from such unlawful conduct.

|

Finally, Remember the Basics:

-

Use plain language.

-

Set clear expectations for attendance, conduct, and discipline.

-

Include that the handbook is not a contract of employment and does not modify the at-will nature of employment.

-

Include that the policies within the handbook may be revised, modified, or revoked at any time, with or without notice.

-

Make sure that the company retains discretion and flexibility when making decisions.

-

Ensure that you actually follow the policies!

If policies are outdated or no longer followed, that's a clue that your handbook needs a thorough update.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Two Winners in Americas Print Awards

Two entries from Excellence in Print were winners in the Americas Printing Association Network’s (APAN) inaugural presentation of the 2022 Americas Print Awards, a national competition that recognizes the absolute finest in printing across the United States. The winning pieces will be on display at Americas Print Show 22 www.americasprintshow22.com in Columbus, Ohio, August 17-19, 2022.

Recipients of the inaugural Americas Print Awards are:

-

BEST SOFT COVER BOOK AWARD – Printing Specialist Corporation, Annapolis Junction, MD for Period Architecture

-

JUDGES CHOICE AWARD – HBP, Hagerstown, MD for 14 Stations at the Crossroads

It's never too early to start collecting entries for next year's Excellence in Print to be held at Martin's West in Woodlawn, MD April 2023

Printing Industry Performance Surveys

“Financial Benchmarks, Ratios, and Actionable Thoughts from the March 2023 PIPI Survey” report. The report provides benchmarks and ratios to assess your firm’s performance and plan a path forward. The report includes income statements and cost categories as a percentage of revenue, balance sheets and related ratios, and cash management indicators. We had enough surveys to generate numbers for high performers and a few industry segments. In addition to the financial numbers, we provide actionable thoughts for you and your management team. Thanks to all who participated in the survey.

October 2023 Big Picture Revenue Trends, Business Outlook

October 2023 Inflation, Supply and Paper Rates

October 2023 Employer Branding

March 2023 Financial Benchmarks, Ratios, and Actionable Thoughts from the March 2023 PIPI Survey

October 2022: Connecting a Comprehensive Strategic Approach to Printing Firm Performance

October 2022 How Paper Is Affecting Printing Companies and Approaches to Consider

October 2022 Survey Results: Revenue Trends, Inflation Effects, Business Outlook

April 2022 Survey Results: Revenue Growth

April 2022 Survey Results: Marketing, Sales, Social Media

Paper Supply Chain: A Deeper Look at our PIPI Data

Paper Supply Chain:

A Deeper Look at our October PIPI Data,

and the BIG Takeaway

Dr. Ralph Williams Jr.

Associate Professor of Management

Jones College of Business

Middle Tennessee State University

Dr. Richard Tarpey

Assistant Professor of Management

Jones College of Business

Middle Tennessee State University

Here’s a formula:

Paper mills producing less printing paper + pandemic-related shipping problems from overseas + labor shortages and strikes at mills + an increase in demand = significant delivery delays, some unavailable products, and significantly higher costs.

A few years ago, who could have imagined that our industry would face these paper supply issues?

In our October PIPI (Printing Industry Performance and Insights) study, we explored how supply chain problems affected our industry and how high-performing firms reacted to these issues. Recently, we stepped back and took a deeper look at our data to consider what printing company leaders might learn from a 30-thousand-foot overview. What’s the big takeaway?

Applying more sophisticated statistical analysis reinforced what we saw in our first look at the data: higher-performing firms proactively address paper supply issues. They are preemptive in their approach, seeking actions that forestall future disruptions. This strategy contrasts with a reactive approach – applying band-aids when a problem surfaces. Here are examples of proactive supply-chain tactics:

-

Seeking relationships with alternative suppliers, even when solid relationships are present.

-

Discussing future projects with customers and negotiating plans to order paper well ahead of when the project is ready to start.

-

Have scheduled meetings with suppliers to discuss the current situation and have open-ended, creative discussions of potential approaches.

-

Aggressively seek to reduce waste.

-

Continuously and objectively assess suppliers’ commitment to your firm and your trust in them.

-

Review your history of purchases, consider your sales forecast, and build a paper inventory.

-

Continuously monitor relevant financial ratios – such as days-in-inventory and days-in-accounts payable – and adjust as needed.

So, what’s the big takeaway from all this? Be Proactive!

One would think the pandemic taught company leaders to be more proactive in preparing for “black swan” events. However, consider prior events that significantly disrupted supply chains in other industries, such as the Southeast Asia tsunami in 2004 or the Tohoku earthquake and subsequent tsunami in 2011. After these events, many companies discussed the need to be more proactive and more diligent with their risk management strategies, However, 10-20 years later, many had not taken significant measures toward hardening and insulating their supply chain. While it would have been impossible to foresee or mitigate a total shut-down of the global economy, many companies failed to learn from these past events how to undertake a basic proactive approach.

Let’s expand this “proactive approach” beyond the supply chain. What can you do to prompt “proactive thinking” by your team from a broad view of your firm?

Most are familiar with “SWOT” (Strengths, Weaknesses, Opportunities, and Threats). But how many of you apply SWOT in your leadership. In consulting printing firms, I found SWOT discussions especially effective in prompting proactive thinking. Indeed, looking back, I should have applied SWOT more in the three printing companies I led. Consider discussing these questions with your team regularly.

-

What are our internal strengths (something we do well), and how can we use those strengths to serve our customers better and attract new business?

-

What are our internal weaknesses (competitive disadvantages), and what is our plan to address those weaknesses?

-

What are potential market opportunities for our company, and what’s our plan to leverage those opportunities?

-

What are external threats to the company’s well-being, and what’s our plan to prepare for those possible occurrences?

Bottom line… from the current paper supply-chain issues, grow your team’s ability to think proactively on an ongoing basis. Consider discussing SWOT monthly to prompt proactive thinking. Leaders, take a positive away from the present paper mess!

The Paper Supply Chain Update. The Straight Truth.

No single issue is impacting the printing industry more than the shortage of paper and the significant rise in costs when stock is available. So, on behalf of our print members, we wanted to ask the experts, where we are, how we got there and what does 2022 and beyond look like for our industry. On February 3, 2022. Upwards of 60 participants from over 35 different companies took part in a webinar hosted by Tony Golden of Lindenmeyr-Munroe Paper Co with presentations by Gilbert Goodworth of Domtar Paper and Mike Robinson of Verso.

While we are facing unprecedented challenges, the seeds for our current situation were planted years ago as demand for all grades of printing paper started to fall. The response on the part of the mills was to close some, reduce capacity at others, take machines offline, and in some cases, repurpose machines to produce products in growing segments like packaging. So, when demand increased in the latter part of 2020 and throughout 2021, at a time of lower overall capacity, unprecedented stress was put on the supply chain and that pressure included pulp, chemicals related to papermaking, and even things like lumber and nails for pallets used in the shipping of paper. It seemed that everything that could be a problem, became one.

While the current challenges cross all types of paper, the speakers presented two very different perspectives. Coated paper is heavily dependent on imports for well over 50% of production and the issues facing them include covid’s impact on the workforce, increase in demand, difficulties in the countries of origin and transporting paper through US ports. Uncoated is primarily made in North America and their problems differ only in that the paper doesn’t have to travel from foreign ports. The 2022 election season will further stress the paper supply, coated cover, in particular, the substrate used for many of the products associated with election mailings and handouts.

While concerns raised by the presenters included machines that are running beyond sustainable capacity, increasing trucking and maritime costs and shortages all along the chain including a significant shortage of truck drivers, there was some good news. Demand continues to be robust with Q4 2021 production 79,000 tons (5%) higher than Q4 202. The presenters shared some statistics about how print products have performed in the last year. There was a 6-9% increase in book sales over 2020, a forecasted increase in commercial print of 5.2-6.2% over 2021 and global direct mail is expected to grow from 71+ billion to 72+ billion in 2022.

Summary

Currently, almost every mill is on allocation/ reservation. There had been a ten-year, or more, lessening of demand for printing papers that the pandemic only exacerbated. While we are facing the perfect storm of chemical, pulp, pallet supply, shipping challenges, and Covid 19’s effect on workforce, demand increased and affected all grades of sheets and web grades.

At the time of this webinar, no mill can allocate 100% of past usage to their customers, and thus the guessing game each month is how much can the mill supply. It can be as low as 60% and there is little light at the end of the tunnel for the foreseeable future. All the experts on the webinar stressed that paper machine efficiency is critical and that all machines, coated and uncoated, are running beyond the safe range for sustainability. To add to the difficulties, some machines may have to go offline in 2022 for maintenance. Everything related to the manufacturing and bringing to market of paper has risen significantly since the start of the pandemic.

What can you do? Plan ahead with your clients, order well in advance, be flexible about grades and finishes and prepare for a challenging 2022. At present, there is little light at the end of the tunnel but be assured that the merchants and the mills are doing everything they can to help their customers thrive in, what continues to be unprecedented times!!

Headline: Inflation

-

-

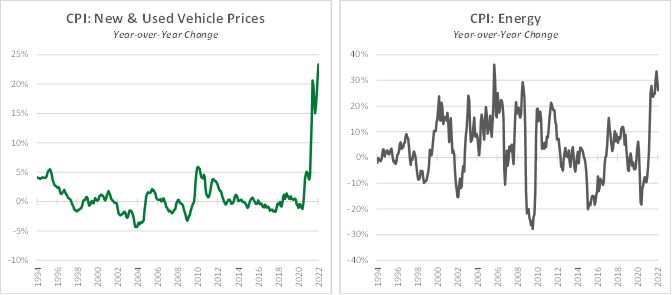

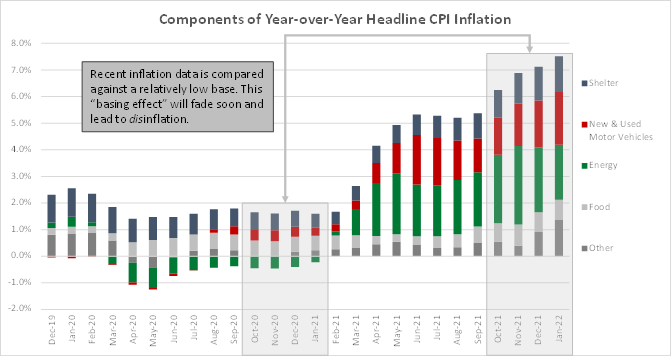

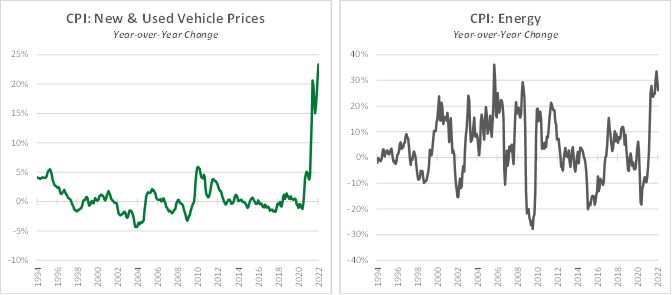

The most recent Consumer Price Index (CPI) data was released and is once again making headlines as the index rose 7.5% for the 12 months ending in January, the largest one-year increase in nearly 40 years. If that last line sounds like a broken record, it’s because the last four announcements starting with last October’s data have all carried that distinction with year-over-year changes consistently higher than 6%. The last time CPI inflation was that high was October 1982.

The Fed received a great deal of criticism for describing inflationary pressures as “transitory” and dropped that label from their official commentary late last year. While that decision has been validated by six consecutive months of accelerating inflation on a year-over-year basis (5.2% à 5.4% à 6.2% à 6.9% à7.1% à 7.5%), we will likely see this trend reverse later this year as the factors contributing to these large increases begin to fade.

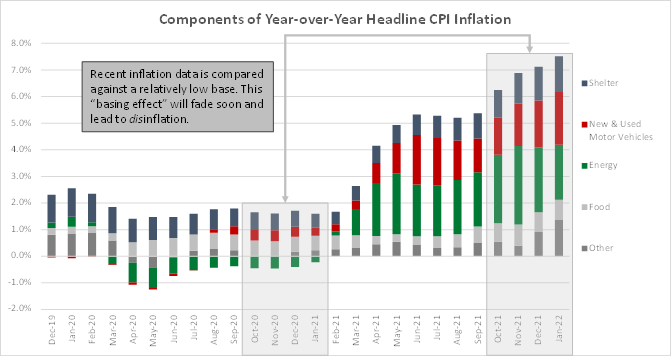

The two main reasons for this deceleration in prices (or disinflation) are 1) the “basing effect” of comparing today’s price index to a time 12 months prior when economic activity was still limited by the pandemic, particularly in the services sector, and 2) relative smaller components of the index having an outsized contribution due to significant price increases that are not expected to be sustained going forward. Take vehicle prices and energy costs as two examples. These categories each comprise ~7-8% of the overall CPI, yet they account for nearly half of the increase in the index over the past 12 months. New and used car prices increased less than 0.5% on average pre-pandemic, but in January vehicle prices had increased more than 20% from the year prior, and energy prices are nearly 30% higher.

It’s highly unlikely that vehicle prices continue to rise at the current pace as supply chain issues ease. In fact, we could experience outright deflation in the vehicle index given its unprecedented increase over the last 12-24 months. And while energy prices could remain at current elevated levels, we don’t believe further increases are likely as high prices incentivize additional capacity and production, thus removing that accelerant from the CPI data. As the chart below shows, the fading of the red (vehicles) and green (energy) components of the index moving forward, combined with the overall basing effect, would result in a significant decline in the inflation readings we see in the second half of this year.

The key risks to this outlook are labor market dynamics and the housing market. Shelter is the single largest component at ~33% of the CPI, and housing price increases tend to have a lagged effect on the index, so we could see continued increases in this component. This will be counterbalanced by increased interest/mortgage rates slowing future activity. As for the labor markets, last Friday’s Employment Report indicated some easing to current tight labor market conditions as new jobs were higher than expected and previous jobs numbers were also increased materially higher, but it’s very early stages here so this is something we’re monitoring extremely closely.

Fed rate hike expectations have been accelerated and increased by investors so far this year. For as much pressure as the Fed is facing now to raise rates, if economic growth and inflation do indeed start to decelerate in the second half of this year, we could very well see a pause in the current expected trajectory and/or magnitude of Fed rate hikes (not to mention what impact politics may have later this year as we approach the midterm elections). This may provide some temporary relief to equity markets later this year, but – for now, at least – “the highest inflation in nearly 40 years!” will be the continued refrain a little while longer.

Posting OSHA Form 300A for FY 2021

Posting OSHA Form 300A for FY 2021

The Occupational Safety and Health Administration (OSHA) requires employers to post Form 300A for injuries that occurred during the previous year from February 1-April 30. Read more

Employers are only required to post OSHA Form 300A (summary), not the OSHA 300 log. March 2, 2022 is the deadline to electronically report your OSHA Form 300A data for calendar year 2020. Employers with ten (10) or fewer employees and employers in certain industry groups are normally exempt from federal OSHA injury and illness recordkeeping and posting requirements.

The ITA website (Injury Tracking Application) should be used to electronically submit required injury and illness data. The website also has instructions for completing the Form 300A.

Recording workplace exposures to COVID-19

OSHA recordkeeping requirements mandate covered employers record certain work-related injuries and illnesses on their OSHA 300 log (29 CFR Part 1904).

COVID-19 can be a recordable illness if a worker is infected because of performing their work-related duties. However, employers are only responsible for recording cases of COVID-19 if all the following are true:

1. The case is a confirmed case of COVID-19 (see CDC information on persons under investigation and presumptive positive and laboratory-confirmed cases of COVID-19);

2. The case is work-related (as defined by 29 CFR 1904.5); and

3. The case involves one or more of the general recording criteria set forth in 29 CFR 1904.7 (e.g., medical treatment beyond first aid, days away from work).

Employers should follow the OSHA enforcement guidance found in the Updated Interim Enforcement Response Plan for Coronavirus Disease 2019 (COVID-19).

Visit OSHA's Injury and Illness Recordkeeping and Reporting Requirements page for more information.

Excellence in Print 2022

MD Relief Act Summary

Maryland RELIEF Act Summary

*sources: Comptroller’s Office, Governor’s Office, DLS

- Sales and Use Tax Credit – Authorizes eligible vendors to retain an increased vendor tax credit for the three consecutive months following the enactment of the law. The amount of the vendor credit allowed is equal to the lesser of the amount of sales and use tax collected during the month the vendor qualifies for the increased credit or $3,000, not to exceed $9,000 in three months.

- Eligibility: a vendor must file a timely sales and use tax return or consolidated return, and; the gross amount of sales and use tax remitted with the return may not exceed $6,000, and; a vendor must choose to forgo the standard vendor credit in order to claim the enhanced vendor credit.

- When? Credits will be granted during the months of March, April, and May 2021. If you file returns quarterly, claim the March credit on the return you file in April, and claim the April and May credits on the return you file in July.

- Amount: Eligible vendors may claim a credit against their sales and use tax for either the amount of the sales and use tax collected during the month for which the vendor claims the credit or $3,000, whichever is less.

- Business Tax Relief

- Unemployment Tax Relief for Small Businesses

- An employer’s 2021 unemployment tax rate will be calculated based on their non-pandemic experience by excluding the 2020 fiscal year, and instead by using the last three fiscal years of 2017, 2018, and 2019. This was already in effect via executive order but a change in law was necessary for it to remain in play beyond the state of emergency.

- Small businesses and nonprofits with fewer than 50 employees will be allowed to defer unemployment insurance tax payments in calendar year 2021 to January 2022

- The RELIEF Act’s loan and forgiveness plan safeguard Maryland business owners against any tax increase triggered by the use of state loan or grant funds.

- Unemployment Assistance - $1,000 one-time grant payments to certain individuals whose unemployment claims have been in adjudication for 30 days

- Eligibility: The Department of Labor determines the recipients of the grants and will submit to the Comptroller a list of individuals who will receive payment

- When? Payments will be sent to qualified individuals from March-July, dependent upon when the eligibility is determined by the Department of Labor

- Unemployment Insurance Income Tax Subtraction - The RELIEF Act provides a State Income Tax Exemption for Unemployment Insurance (UI) Benefits for qualifying filers. UI payments are currently subject to federal and state income taxation. Beginning with Tax Year 2020 and including Tax Year 2021, the Act exempts from the state income tax the UI benefits received by an individual earning less than $75,000, and couples filing jointly or individual heads of households earning less than $100,000.

- Grant and Loan Programs – New grant and loan programs for businesses and nonprofits to be administered by several state agencies, and local governments (see attached for local programs)

- Maryland Economic Development Assistance Authority and Fun

- Grant program for businesses in distressed communities to assist the businesses in setting up an online sales framework and offering employees telework opportunities

Other provisions:

- Authorizes the Department of Commerce to forgive up to $50,000 of a loan, if the loan was made to a small business under the Equity Participation Investment Program with the Maryland Small Business Development Financing Authority. This provision applies only to fiscal 2021 and 2022 loans provided to relieve the adverse effects of the coronavirus pandemic.

- Creates a $420 million fund within the Department of Budget & Management to be used for:

- Financial assistance to individuals, businesses, and nonprofit organizations

- Funding for the Department of Health and UI program

- The restoration of Department of Transportation transit services and highway maintenance funding.

Joint Letter to the Postmaster General

February 19, 2021

The Honorable Louis DeJoy

Postmaster General

United States Postal Service

475 L’Enfant Plaza SW

Washington DC 20260

Dear Postmaster General:

As representatives of your customers, the undersigned are writing to you in an effort to clearly convey the fragility of customer confidence in the Postal Service, given the recent collapse in service, and the danger of increasing prices under such circumstances.

We understand the impact of the pandemic – our member companies and nonprofit organizations, and their customers, are experiencing it as well – and of other factors that have impaired USPS operations and delivery. As the Postal Service has acknowledged, that impairment was worsened by internal failures to maintain control over inventory and follow established procedures and operating plans.

As a result, customers have experienced delays of not just a few days but weeks – even months – in getting their personal correspondence, greeting cards, statements, advertising mail, newspapers, magazines, and packages to their recipients. In turn, many customers, from the clients of commercial mailers to everyday users of retail services, now question whether they can depend on the Postal Service in the future. The collapse of service experienced in recent months has the potential to significantly accelerate the abandonment of mail; it has already resulted in messages to consumers encouraging them to “go paperless.”

In this context, increasing prices for substandard service should not even be considered. Any action that would drive away already skeptical customers would worsen the Postal Service’s challenges. Any short-term increase in revenue from an over-CPI price change would be outweighed by its long-term business impact. We believe there are better measures that could be undertaken to restore financial equilibrium.

As you have noted, the burdens imposed by Congress could be alleviated through successful discussions with legislators; reform legislation could remove unnecessary retirement prefunding obligations; USPS employee costs could be reduced through more disciplined negotiations; and operational efficiencies can be implemented that do not require diminishing service standards. Yes, those would be more difficult than simply raising prices, but also would yield greater and more long-lasting benefits – without imperiling mail volume.

The Postal Regulatory Commission has provided greater pricing authority to the Postal Service. When the commissioners concluded the USPS was not financially stable, the tool they used to remedy that condition was alteration of the rate-setting mechanism to enable greater price increases. The challenges facing our industry require a more thoughtful and comprehensive approach than for the Postal Service to mechanically maximize its rate authority, separately or as part of a broader plan, simply because it was provided with the opportunity to do so. Moreover, the availability of $10 billion in funding under recent legislation, and the ongoing positive income derived from increased parcel volume, lessen the urgency to seek additional revenue from ratepayers.

The Postal Service’s financial condition did not develop overnight and is not simply due to inadequate revenue – nor can it be remedied simply by raising prices, particularly through an unanticipated increase at a time when customer allegiance has been so severely compromised by poor service. Customers already prepared to walk out the door should not be asked to pay more – now or in the future – for something whose value they concurrently have reason to doubt.

We look forward to working with you to strengthen the Postal Service and ensure its future. We are also prepared to collaborate on an integrated and comprehensive approach to the challenges we face together. We stand ready to discuss these and other issues at your convenience.

|

Sincerely, Stephen Kearney

Executive Director

Alliance of Nonprofit Mailers

|

Hamilton Davison

President and Executive Director

American Catalog Mailers Association

|

|

Mark Pitts

Executive Director

American Forest & Paper Association

|

Steve Krejcik

President

Association for Mail Electronic Enhancement

|

|

Michael Plunkett

President and Chief Executive Officer

Association for Postal Commerce (Postcom)

|

Rita D. Cohen

Senior Vice President, Legislative and Regulatory Policy

MPA – The Association of Magazine Media

|

|

Christopher Oswald

Senior Vice President, Government Relations

ANA – Association of National Advertisers

|

Michael Plunkett

President

Delivery Technology Advocacy Council (DTAC)

|

|

Maynard Benjamin

President

Envelope Manufacturers Association

|

George White

President

Greeting Card Association

|

|

Kate Muth

Executive Director

International Mailers’ Advisory Group

|

Leo Raymond

Managing Director

Mailers Hub

|

|

Todd Haycock

President

Major Mailers Association

|

Robert Galaher

Executive Director

National Association of Presort Mailers

|

|

Tonda Rush

General Counsel

National Newspaper Association

|

Arthur B. Sackler

Executive Director

National Postal Policy Council

|

|

Paul Boyle

Senior Vice President / Public Policy

News Media Alliance

|

Jim Cochrane

Chief Executive Officer

Parcel Shippers Association

|

|

Donna Hanbery

Executive Director

Saturation Mailers Coalition

|